Metadata

- Author: Pau Fernandez

- Full Title:: The Three Sets of Reports to Grow Your SaaS

- Category:: 🗞️Articles

- URL:: https://entersaasman.substack.com/p/the-three-sets-of-reports-to-grow?r=2041um&utm_campaign=post&utm_medium=web&utm_source=substack

- Finished date:: 2024-01-08

Highlights

All I Want Is To Know Whats Different

Consistency: as mentioned earlier, there are things more important than having the correct data. If you have the right data, but change how to measure it, the indication you are viewing won’t make sense. In companies that are not mature, and which therefore experience a lot of changes, it’s key to analyze a set of metrics over time. If you change the way to evaluate those metrics, those will only fool you. Remember that there’s no perfect benchmark for your company, the closest proxy is your past because it measures your team, your market, your tech, and your moment…, and all of that is unique to you. (View Highlight)

If you go to a traditional bank they’ll require some information that you probably don’t use for your business. On the other hand, if you go to a VC to get funding, the analysis they’ll perform will be closer to what you’d do monthly. (View Highlight)

Management: this is from my humble point of view, the most important reason. Accounting needs to serve the business. Here’s where most CFOs struggle. It’s not what you got taught in your Big4 days, it’s what the company needs to know. (View Highlight)

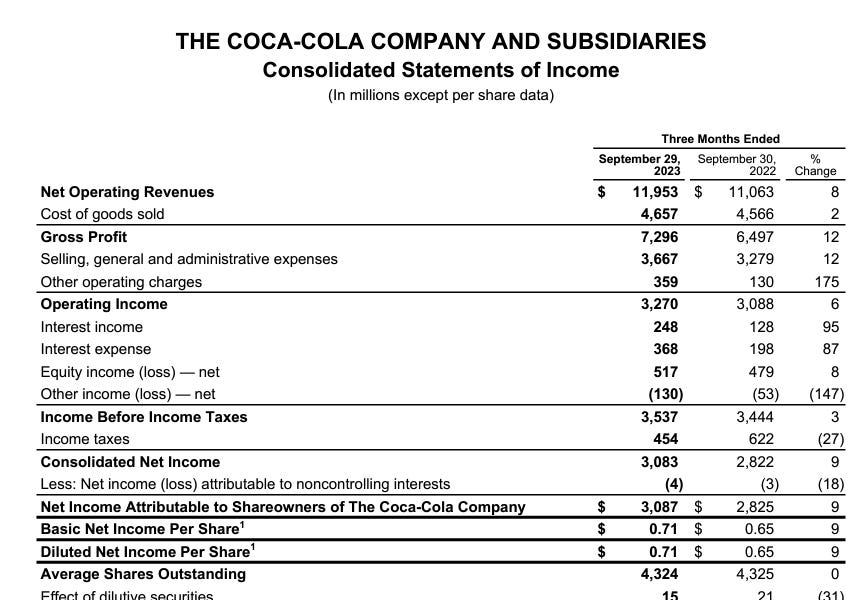

Profit & Loss (aka Income Statement): if a BS was a photo, the PL is the movie between 2 photos (View Highlight)

In the general scheme of SaaS reporting, I give accounting reporting less than 10% of the value for the whole reporting package. Accounting is a good information source for other reports, but besides the Cash Flow, it’s not representative of your SaaS. (View Highlight)

The SaaS Masterfile is a report that will be required by every VC (Venture Capital investor). If a VC doesn’t ask for that, don’t let them invest in your SaaS as you don’t want someone in your Cap Table who doesn’t understand how SaaS works, do you? (View Highlight)

It’s important to state that MRR is usually not the same as billing, MRR, or Monthly Recurring Revenue is the amount pretax in your currency that you would bill the client at the last minute of the month if they had a monthly plan. For that reason, the MRR will not match with the revenue from your PL report (View Highlight)

New highlights added 2024-01-10

Lead: It is a contact related to a company that you know how you have acquired. You still don’t know if it fits your ICP (Ideal Customer Profile) (View Highlight)

In future posts, I’ll talk about specific metrics, but the ultimate metric on SaaS is Payback. Payback, besides a not-so-good movie, stands for the period that you need to recover the acquisition investment and it’s calculated by dividing the CAC (Cost of Acquisition per Customer) by the ARPU (Average Revenue per Customer). (View Highlight)